Hurry. Cohort 11 LAUNCH Offer $1000 OFF Ends Sunday at 5PM EST.

A uniquely powerful system to

Use Algorithms, Professional-Grade Tools, And Automation For Investment Growth

The Exact Algorithmic Trading Strategies & Professional Tools That We Use To Automate Our Proprietary Hedge Fund—Simplified For The Solo Trader.

Stop struggling with emotional trading.

Finally start automating your investments with algorithmic trading in 2025.

JOIN Over 600+ Students learning algorithmic trading AND using PROfessional-grade tools with Python

Webinar Replay and Special Offer

How To Become A PRO Algorithmic Trader with Python

Learn the Exact Algorithmic Trading Strategies & Professional Tools That We Use In Our Proprietary Hedge Fund

Stop competing in an unfair game.

Start growing your investments with our hedge fund-grade algorithms & professional tools in 2025.

The Quant Revolution

The year was 1987. While Wall Street showcased ruthless ambition, greed, and a trade-by-gut-instincts attitude, a quiet revolution was brewing...

Jim Simons Launched the Medallion Fund

And over the next 30 years it grows at an insane...

44% PER YEAR (AFTER FEES)

By 1994, David E. Shaw's hedge fund was managing $2 billion with 26% annual returns that rivaled even the best traditional hedge funds.

The quants were winning.

But Investors Like You and Me Were LEFT OUT

The Medallion Fund has been closed to outside investors since 1993

Quant hedge funds require $1 million+ net worth, putting them far beyond most individual traders

Professional tools like Bloomberg and Reuters terminals cost $30,000+ per year

The hedge funds have LOCKED THE DOORS on tools and algorithms so they can profit

Until Everything Changed in 2002...

Interactive Brokers opened up direct-market access to everyone from hedge funds to home offices.

A Seismic Shift Was Happening

❌ The Old Way (1980s): Human brokers, slow phone execution, $25-$50 commissions

✅ The New Way (1990s-2000s): Electronic Communications Networks, 1000X faster computer processing, $0.007 per share

This gave rise to the decade of Python

From 2010 to 2020, the Python ecosystem for algorithmic trading exploded.

Python got core data foundations, backtesting frameworks, and professional tools that empowered individual algorithmic traders for the first time.

The wild story of how Jason and Matt built a hedge fund from scratch with Python...

Dear Friend,

If you've been, like us, thinking of starting your own solo-trading operation with algorithms, automation, and Python to grow your investments faster than "the market", then this is for you.

In 2022, Jason Strimpel and Matt Dancho (me) came together with one mission:

To give you the exact algorithmic trading strategies and professional-grade automation tools that hedge funds actually use and execution with Python.

And it was working.

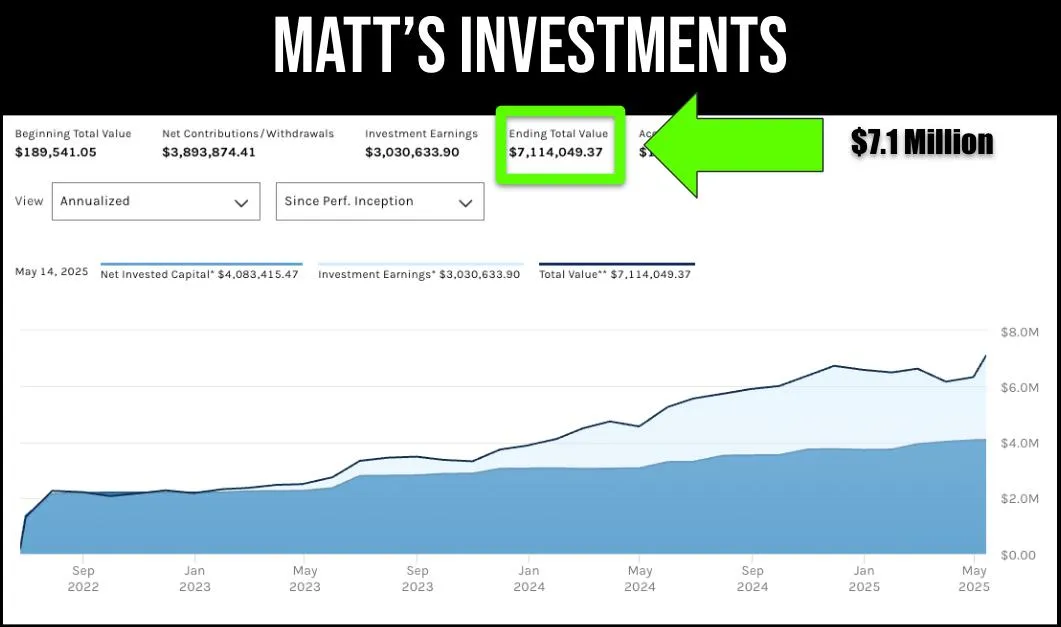

From 2022 through 2025, our investments were already growing at double the S&P 500 with the same amount of risk...

Jason Strimpel

Matt Dancho

Matt's $7,276,854 Investment Portfolio Was Growing DOUBLE the S&P500

But most importantly, using only our trading algorithms, our students were getting results too.

In days from starting our initial program, our students were growing their accounts.

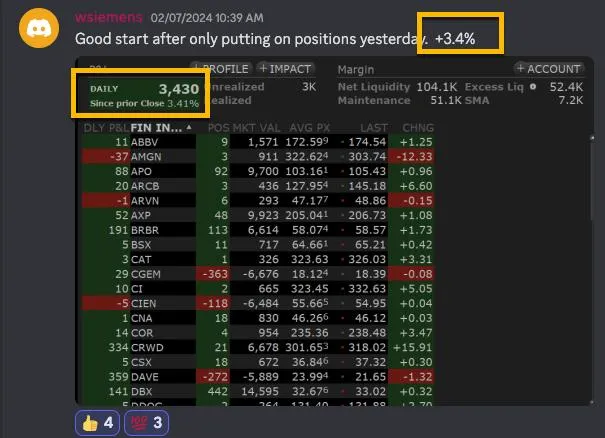

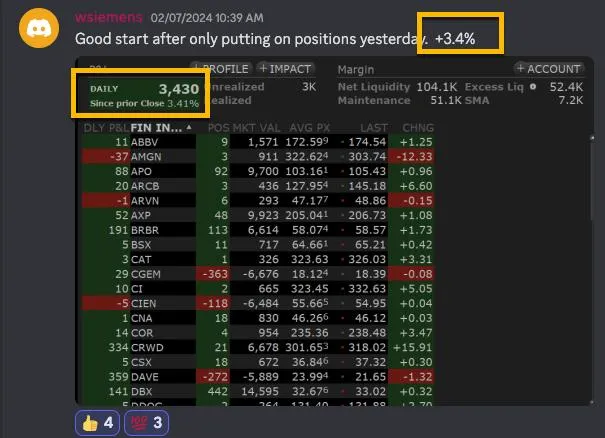

wsiemens was up $3,430 (+3.4%) in 1 day.

Masa was up $2,870 (+2.8%) in 4 days.

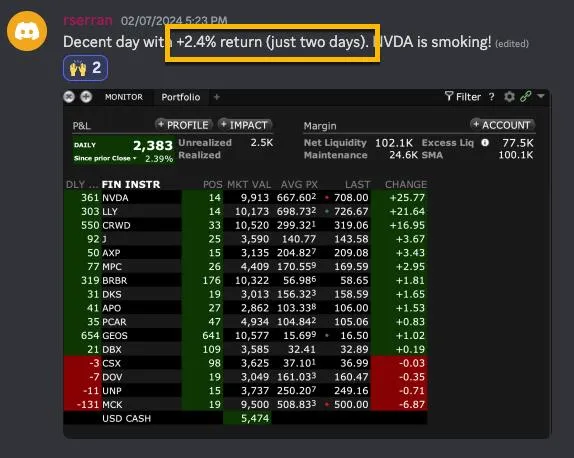

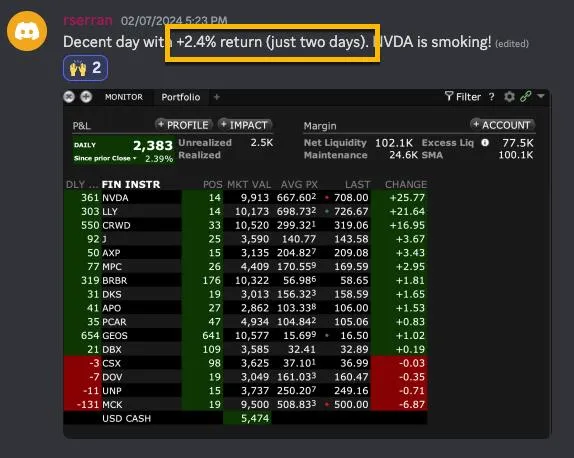

Ricardo was up $2,383 (+2.4%) return in 2 days.

Join over 500+ students unlocking hedge fund secrets with Python

Every beginner faces these...

Don’t know how to get started

Are you overwhelmed with the number of different platforms, techniques, and strategies out there for algorithmic trading?

Not making any progress

Are you hacking a way at YouTube Videos, listening to podcasts, and never gaining any traction?

Tough learning finance domain

Do you find yourself struggling to pick up trading jargon and making sense of it all?

The wild story of how Jason and Matt built a hedge fund from scratch with Python...

What happened next was shocking.

But that's old news...

We had bigger ambitions to automate our trading by building a Hedge Fund with Python

In June of 2024, Jason and I decided to make the leap- To build a hedge fund from scratch using our 20+ years of experience in Data Science and Quantitative Finance.

We were already making good money in the market...

...But now, Jason and I wanted to implement an even more powerful system so we could grow our trading faster with an automated system.

Honestly, Jason and I thought building the hedge fund would take one month (maybe two) to get the fund up and running.

We were wrong!

❌ The Problem We Faced When Automating Our Trading

(and you'll face too)

We were up against giants.

Hedge funds have teams of quants, cutting-edge software, and real-time data feeds costing $10,000,000+ annually—tools far beyond basic charting platforms or delayed data that we have access to.

They analyze markets, seize opportunities, and execute trades with precision while we're left guessing- Not because we are any less smart or capable. They have better tools, algorithms, and execution.

This isn’t just an uneven playing field—it’s a financial disadvantage that cost us profits daily.

Let's Face It- Hedge Funds Have Better Tools

Tools Gap: Hedge funds ingest live market data through $30,000 terminals, deploy clusters for backtesting, and automate micro-second execution. Most retail traders juggle delayed charts, spreadsheets, and mouse-clicks.

Research Bottleneck: A single parameter tweak can take hours to test. Meanwhile, quants sweep thousands of variations overnight, discarding losers and trading winners.

Execution Risk: One fat-finger order, slippage, or stale price can erase a month’s gains. Institutional desks have algorithmic monitors and fail-safes; the average trader has… hope.

This is why individual traders like you and me are at a huge disadvantage.

❌ Python's Open Source "Pro-Tools" Were Fragmented And Incomplete.

Once Jason and I started building our hedge fund, we discovered the algorithmic trading ecosystem in Python was fragmented and incomplete.

We uncovered 3 critical needs:

NEED #1: Financial Data Processing and Storage Was Missing

ZIP files and random CSVs weren't tracked

Fundamental data was missing

Pipelines for data ingestion and cleaning were absent

Professional-grade data warehouse/data lake storage wasn't available

"I was tired of messy CSVs and slow data analysis killing my profits"

NEED #2: Quant Research Experiment Tracking System

Jupyter files are untrackable: strategy_v1.ipynb, strategy_v2_final.ipynb

No quant/data science experimentation pipeline

Makes tracking experiment parameters and performance comparison impossible

"It's tough to track strategies when my best one is in a file named 'Use_This_One.ipynb'"

NEED #3: Execution Management, Automation & Monitoring

No automated execution pipeline set up for trading

No trade monitoring and reporting KPIs

No audit trail connecting trades to specific backtests

No multi-strategy management capabilities

"How do I know if I'm my trades are making money when I'm not notified when things are going wrong?"

Because we lacked Professional-Grade Tools, our process suffered and every problem cost us money

Our data bundles would be outdated or broken

We'd read in the wrong data

We'd inadvertently use incorrect trading strategies

Trading strategies contained data errors

Strategies would overfit because we'd backtest incorrectly

Trade executions would fail

Now imagine the ideal workflow of a hedge fund

You would start by automatically downloading all of your trading data into a high-performance data lake.

Then you would create and backtest dozens of algorithmic trading strategies from a unified research lab that is connected to the data lake.

Once you found a strategy that worked, you would use a robust execution engine to not only submit trades but monitor them to make sure they were profitable and in alignment with your backtest results.

Do you think you think you could grow your trading to $1,000 a day (or more) if you had the same tools as a hedge fund?

Remember: The Problem

Every individual trader LACKS the two things that hedge funds use to automate their trading: professional tools and algorithmic trading strategies.

This is what's holding you back.

Fortunately, we have a solution. And it's proven by students.

The solution you're about to discover has helped over 500 students start, grow, and automate their trading with algorithms and professional tools...

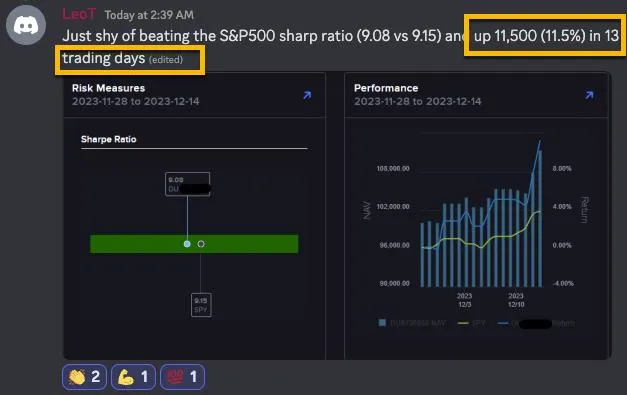

Leo was up $11,500 in 13 trading days (11.5%).

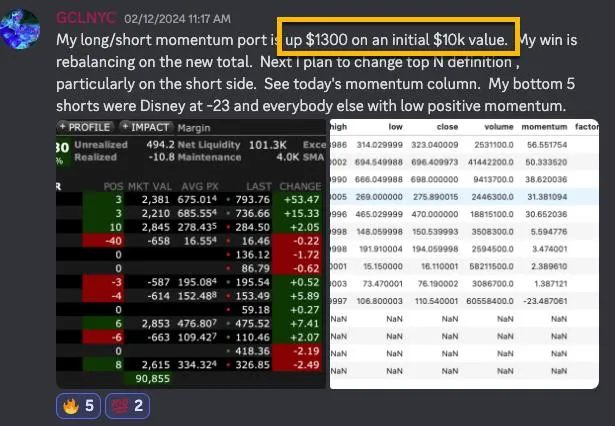

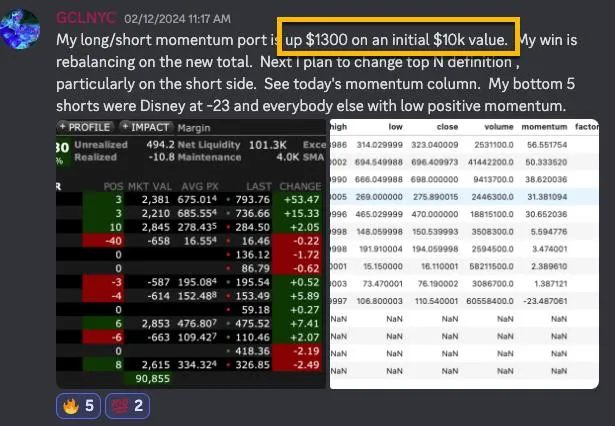

GCLNYC was up $1,300 (+13%) in a week.

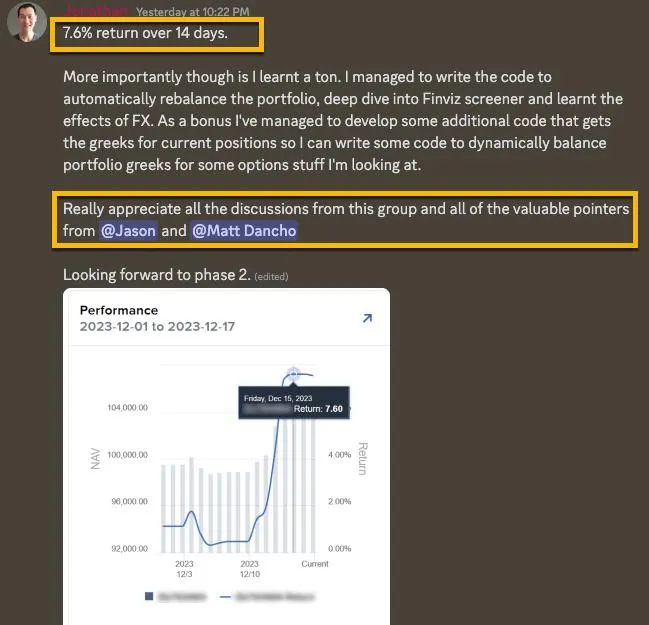

Jonathan was up $7,600 (+7.6%) in 14 trading days.

Jim had a $1,100 (+5.3%) return in 14 trading days.

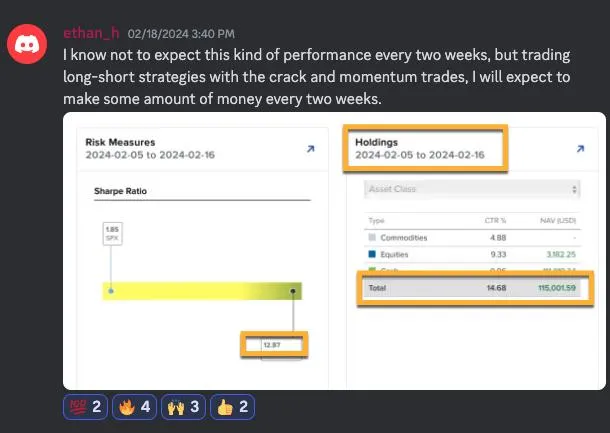

Ethan was up $15,001 (+15%) in 10 days.

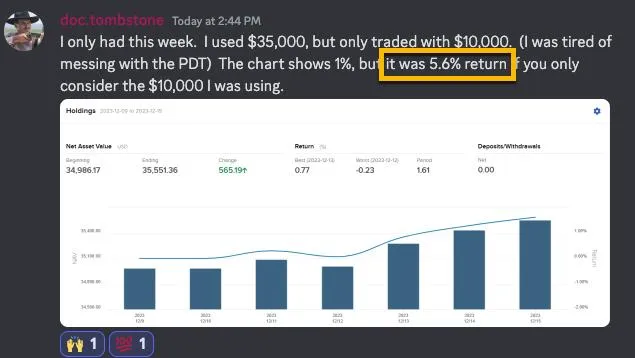

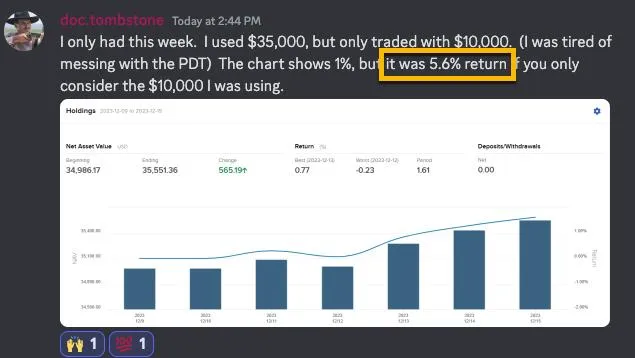

Doc was up 5.6% return in 7 days.

Michal was up $5,352 (+5.2%) in 1 day.

By this point you've realized you can start, grow and automate your investments if you have the professional tools that hedge funds use.

Whether you want to...

Build your investment portfolio more quickly

Prepare for retirement (build an IRA)

Experience life, travel, and have fun

Buy a home

Get rid of debt

Have financial freedom

And save, grow, and reinvest more money

Growing your trading to $1,000 a day (and beyond) is NOT a pipe dream.

Keep reading, and we'll share how this is possible.

You Can Start, Grow, And Automate Your Algorithmic Trading When You Implement The 3 Pillars We Share In The Quant Scientist PRO-Algorithmic Trader System

One Platform, Three Pillars, Powering Our Hedge Fund

You will...

Open a trading account with Interactive Brokers and learn the basics of getting started (if you’re a beginner with no prior algorithmic trading experience)

Get an algorithmic trading system. Plan your way to success, minimize risk, and protect your money (you’ll practice your skills in Paper Trading, i.e. you’ll trade with fake money, build your confidence before you make the leap to live trading).

Automate trading just like the "Big Guys". Get our exact automated trading system that is powering our hedge fund (the same system that makes us money while we sleep).

Make trading for growing your investments a reality without losing money, sleep, or your mind!

These outcomes are totally within reach for you and your investment goals (even if you're starting from scratch or have traded before).

Don't Just Take Our Word For It...

Here Is What Students Are Posting Daily In Our Trading Community

We are literally seeing these successes every day in our Discord Group...

wsiemens was up $3,430 (+3.4%) in 1 day.

Masa was up $2,870 (+2.8%) in 4 days.

Ricardo was up $2,383 (+2.4%) return in 2 days.

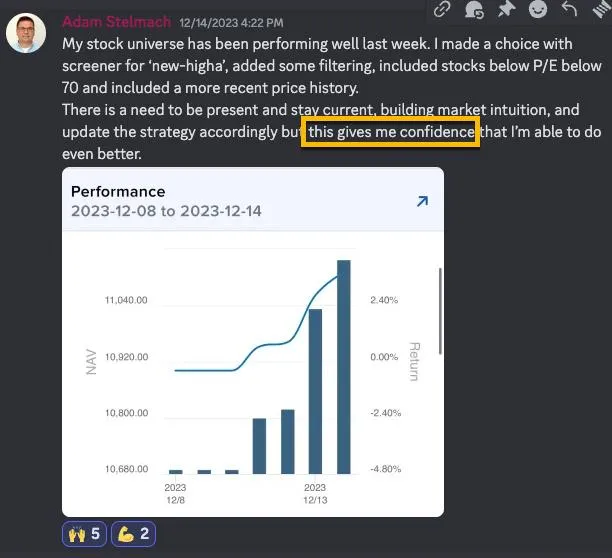

Build Confidence in Your Trading

"This gives me the confidence that I'm able to do better." -- Adam

Pillar #1

High-Performance Financial Data Lake

Professional-grade financial data storage and processing

Pillar #2

Unified Experiment Research Lab

Track and compare 100's of trading experiments

Pillar #3

Robust Execution Engine & Monitoring

Automated trading with real-time monitoring

But Don't Just Take Our Word For It...

This is what it feels like to use the 3 Pillars inside our proprietary hedge fund software...

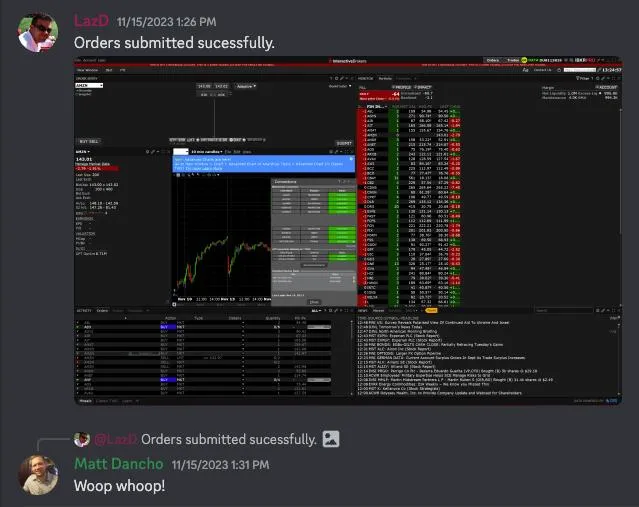

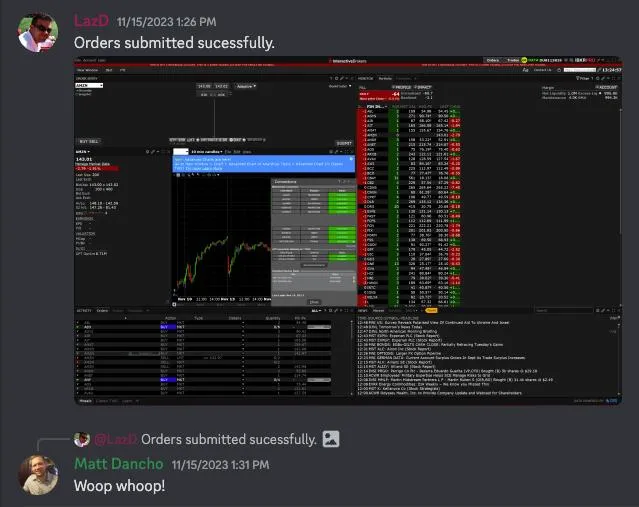

"Orders submitted successfully." --Laz D.

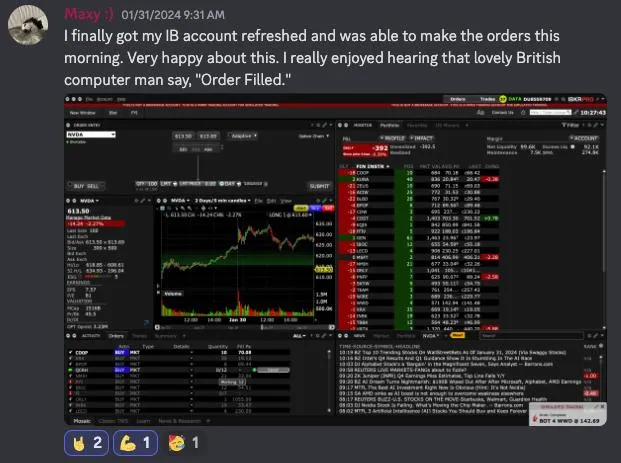

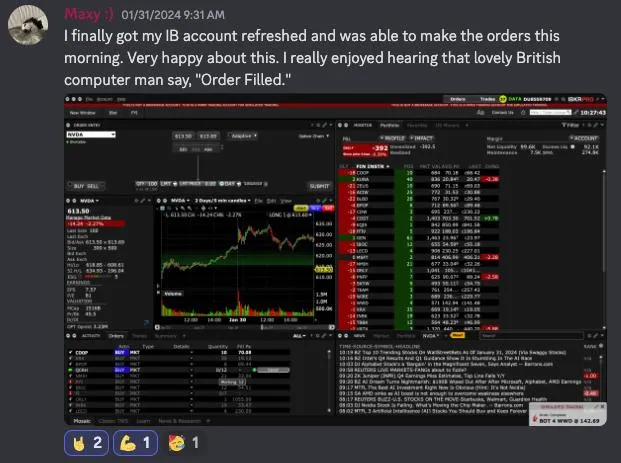

"I enjoyed hearing that lovely British computer man say, 'Order Filled'" --Maxy

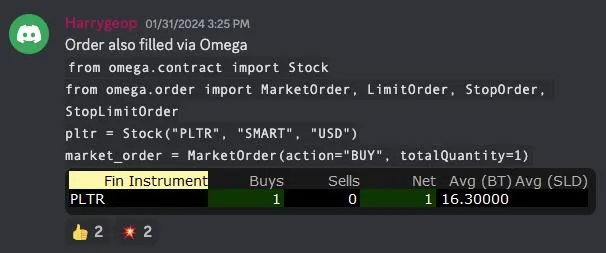

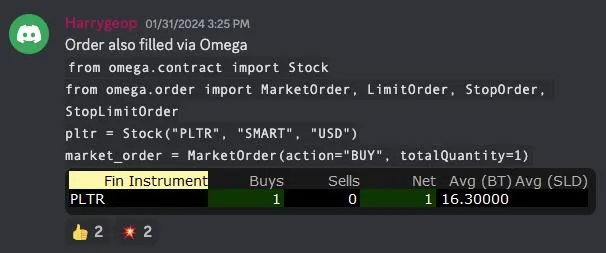

"Order filled via Omega" --Harry

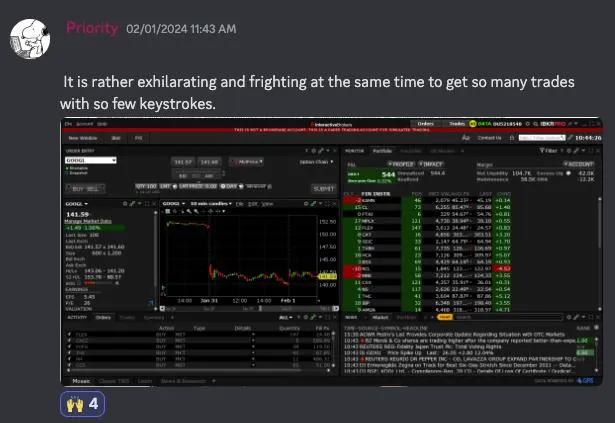

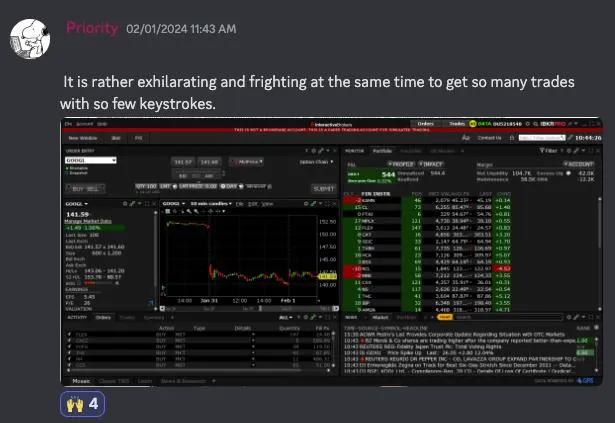

"It's exhilarating and frightening at the same time to get so many trades with so few keystrokes" --Priority

Our Vision: The 3 Pillars

This is 18 months of software development to give you the exact professional tools we use in our hedge fund so you can stack the odds in your favor and win at an unfair game.

Pillar #1

High-Performance Financial Data Lake

Professional-grade financial data storage and processing

Pillar #1 — QSConnect: The Financial Data Backbone

High-performance financial data lake (DuckDB + Parquet)

90,000 Equities & ETFs

30+ Years of Fundamental Data

90,000,000 Rows of Price Data (OHLCV)

Cache Management File System

High-Speed Database

Automatic Zipline Bundling

Yahoo Finance & FMP API Integration

Pillar #2

Unified Experiment Research Lab

Track and compare 100's of trading experiments

Pillar #2 — QSResearch: Your Scalable Research Lab

Complete A-Z Quant Research Lab Workflow

Statistical Analysis of Alpha, Returns, and Performance Metrics

10+ Built-In Feature Engineering Tools

Zipline Backtest Automation

MLFlow Experiment Tracking & Artifact Bundling

1st Class Machine Learning Integration: Scikit-Learn, XGBoost & H2O

Everything you need to manage 1,000’s of trading strategies

Pillar #3

Robust Execution Engine & Monitoring

Automated trading with real-time monitoring

Pillar #3 — Omega: Your Automated Trade Execution Engine

1,000 software development hours went into building this

Streamlines trade execution

32 API connections between Python and Interactive Brokers API

SQL Database Trade Logging

Realtime Profit & Loss

Target Percent Positions

Automatic Portfolio Rebalancing

Wouldn't it be nice to automate Your Solo-Trader Hedge Fund in 1 Line of Code?

Listen, we realize that even beginners want to launch their own solo-trader hedge funds. So we created a new proprietary software that you can run our hedge fund algorithms automatically, in only 1 line of code!

It's literally 1 line of code

(so easy A COMPLETE BEGINNER CAN DO IT)

Here is the 1 line of code that runs our hedge fund:

...That 1 line of code runs our entire hedge fund.

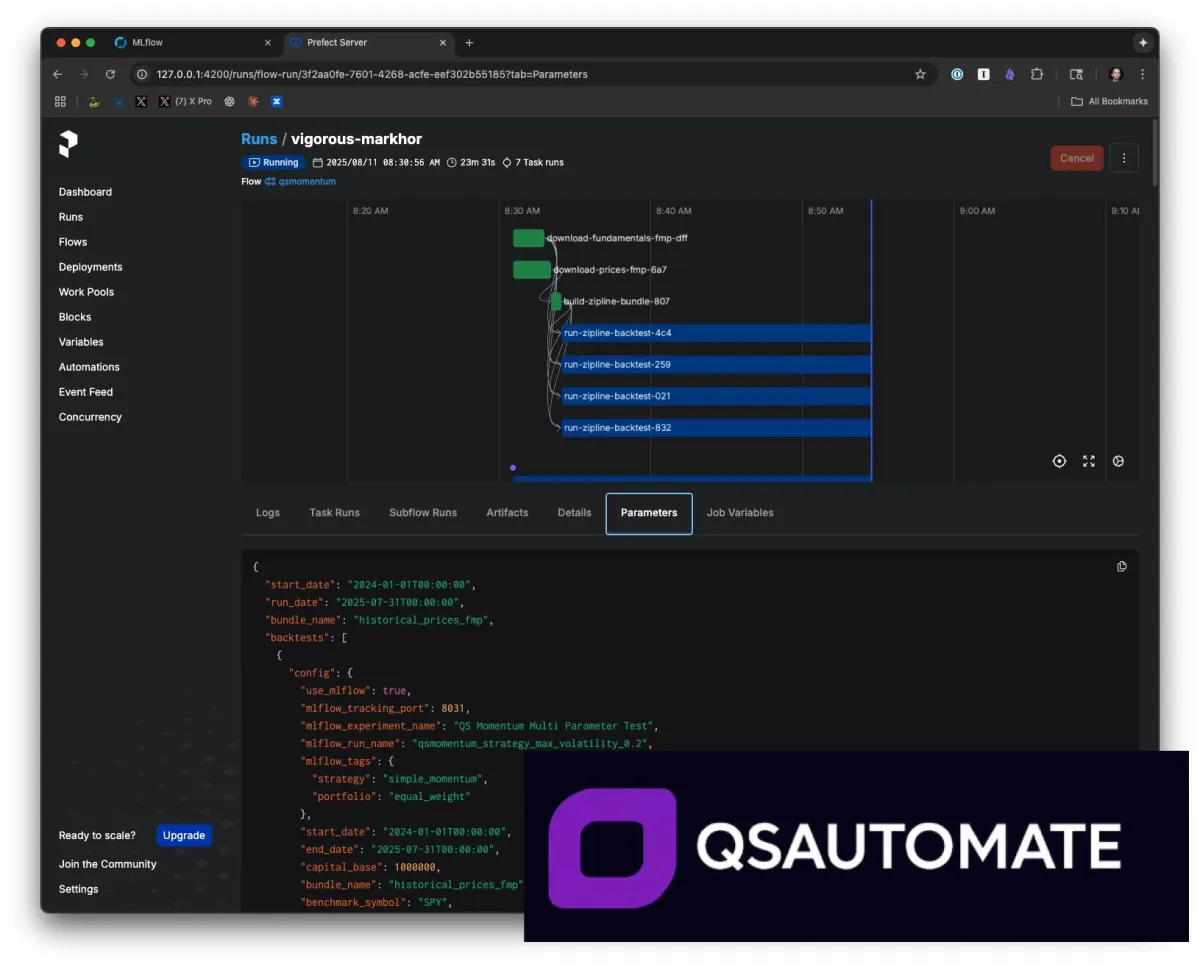

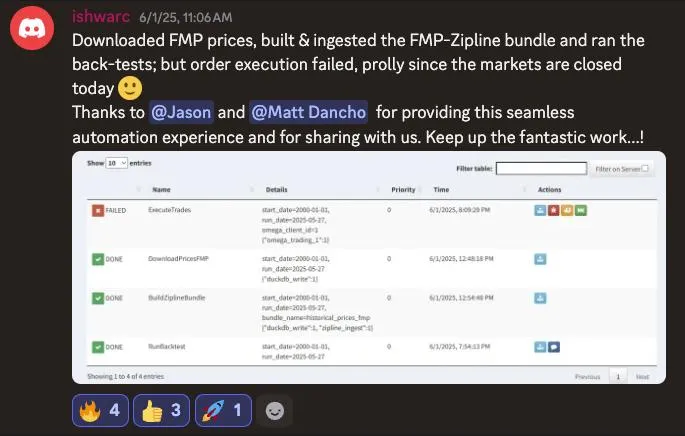

Here our hedge fund running:

Here's some more of what our dead-simple automation software does:

Pillar #4

Automate your hedge fund in 1 line of code

Your trading strategy automation layer

Pillar #4 — QSAutomate: The Automation Software for Your Solo-Trader Hedge Fund

The EXACT production execution pipeline from our hedge fund

Multi-strategy orchestration

Strategy watcher for monitoring trades

P&L reporting and real-time monitoring

Automated rebalancing workflows

Beginner-friendly: Run everything in only 1 line of code!

Then we packaged it into a complete system to help you automate your trading with:

Proven Trading Strategies: These are battle-tested algorithms like volatility targeting and momentum factors that we use in our hedge fund.

Proprietary Software Suite:

QSConnect: High-performance data management for 90,000+ equities and ETFs.

QSResearch: Advanced strategy development and backtesting lab.

Omega: Precision trade execution and real-time monitoring.

QSAutomate: The automation software for your solo-trader hedge fund.

Advanced Training: From foundational skills (Level I) to pro-grade automation and machine learning (Level II).

Live Coaching & Mentorship: Learn directly from Matt and Jason in interactive clinics, mastering their top strategies.

WHAT'S INSIDE OUR UNIQUELY POWERFUL SYSTEM:

Everything you need to start, grow, and automate a profitable investment portfolio FAST.

First, you'll need the exact hedge fund-grade algorithmic trading strategies we use. So for that we have...

LEVEL I: Algorithmic Trading Foundations

learn The exact algorithmic trading strategies we use in our hedge fund.

Live Clinic #1:

Trading Strategy Development

Get our 5-Step Framework for Profitable Trading

Learn our Top 3 Algorithmic Trading Strategies

Trade 1: Volatility targeting with auto-rebalancing

Trade 2: Momentum factor with auto-rebalancing

Trade 3: Algorithmic crack spread versus refiner

$2,499

Live Clinic #2:

Backtesting & Trade Analysis

Detailed walkthrough of event-based backtesting

Backtested portfolio strategies with Zipline Reloaded

How to avoid mistakes in backtesting

Use past data to determine if strategy makes money by skill or luck

$2,499

Live Clinic #3:

Risk Management & Portfolio Protection

Detailed walkthrough of key performance and risk metrics

Risk analysis with Pyfolio Reloaded

Which KPIs actually matter (and which to avoid)

When to iterate (core key risk levels)

How to go directly into paper trading

$2,499

Live Clinic #4:

Live Trade Execution & Advanced Backtesting

Detailed walkthrough of executing and managing trades

1 New Trade: Multi-asset trading strategy

1 New Backtesting Technique: 100X faster backtesting

$2,499

Next, you'll need the exact professional tools we use to automate our hedge fund. So for that we have...

LEVEL II: Professional-Grade Tools

get The exact professional tools we use in our hedge fund.

Live Clinic #5:

Build Your Python-Powered Quantamental Trading System

Build your high-performance quantamental database

Integrate financial data APIs

Ingest price & fundamental data (90,000+ equities and ETFs)

Automate Zipline bundling

Monitor, track, and manage 500+ cached files

$2,499

Live Clinic #6:

Edge Discovery & Validation Using Your Quant Research Lab

Develop and test 100's of factor and ML experiments

Implement price and fundamental factor strategies

Track and compare 100's of algorithmic trading experiments

Statistical analysis and alpha generation analysis

$2,499

Live Clinic #7:

Advanced Machine Learning for Trading 2.0

Solve the "I struggle with predicting future price movements" problem

Advanced feature engineering for ML strategies

Make 100's of predictive ML strategies

Combine price and fundamental data inside predictive ML strategies

Avoid overfitting with proper hyperparameter tuning

$2,499

Live Clinic #8:

Advanced Strategy Deployment & Multi-Strategy Orchestration

Learn the EXACT production execution pipeline from our hedge fund

Multi-strategy orchestration

Strategy watcher for monitoring trades

Automatic P&L reporting and real-time monitoring

Automated rebalancing workflows

$2,499

Listen, We Realize That...

1. Getting started can be tough.

2. Having lifetime access to Professional Tools is a necessity.

3. Executing trades and rebalancing (last mile) is difficult.

So we've poured 3,000 HOURS into our program to solve these 3 problems for you.

(Read On To Learn More...)

For a limited time, we have 4 exclusive bonuses that solve each one of these problems

Exclusive Bonuses (Limited Time)

learn The exact algorithmic trading strategies we use in our hedge fund.

BONUS #1: Python for Algorithmic Trading Fast Track

Solves the "I need help getting started" problem

Very beginner friendly setup guide

Get the Quant Scientist Python Stack installed

Create an account with Interactive Brokers

Set up your Trader Workstation

Connect Python to the Trader Workstation

And execute a paper trading strategy risk-free

$997

$997

BONUS #2: Proprietary Quant Database Software

Solves the "I need to organize data for 90,000+ assets" problem

90,000 Equities & ETFs

30+ Years of Fundamental Data

90,000,000 Rows of Price Data (OHLCV)

Cache Management File System

High-Speed Database

Automatic Zipline Bundling

Lifetime Access to our Proprietary Software

$10,000

$10,000

BONUS #3: Proprietary Quant Research Lab Software

Solves the "I need help managing 100's of algorithmic trading strategies" problem

Complete A-Z Quant Research Lab Workflow

Statistical Analysis of Alpha, Returns, and

Performance Metrics

10+ Built-In Feature Engineering Tools

MLFlow Experiment Tracking & Artifact Bundling

1st Class Machine Learning Integration

Everything you need to manage 1,000's of trading strategies

Lifetime Access to our Proprietary Software

$10,000

$10,000

BONUS #4: Proprietary Trade Execution Software - "Omega"

Solves the "Last Mile" problem

1,000 software development hours went into building this

Streamlines trade execution

32 API connections between Python and Interactive Brokers API

SQL Database Trade Logging

Real-time Profit & Loss

Target Percent Positions

Automatic Portfolio Rebalancing

Lifetime Access to our Proprietary Software

$10,000

$10,000

BONUS #5: Proprietary Trade STRATEGY AUTOMATION Software - "QSAUTOMATE"

Solves the "I can't figure out how to run my strategy on autopilot" problem

Get the EXACT production execution pipeline from our hedge fund

Run Multi-strategy orchestration

Create a strategy watcher for monitoring trades

Automate P&L reporting and real-time monitoring

Run automated rebalancing workflows

Beginner Friendly-- Run everything in only 1 line of code!

Lifetime Access to our Proprietary Software

$10,000

$10,000

This is what it feels like to use the 3 Pillars...

You get the exact workflow we use in our fully automated hedge fund—simplified for the solo trader.

"Thanks to Jason and Matt for providing this seamless automation experience and sharing with us. Keep up the fantastic work."

The Benefits You'll Feel Immediately

Increase Your Returns: Tap alpha-generating trading frameworks and institutional-grade algorithmic trading strategies.

Slash Risk: Volatility targeting, fail-safe orders, Black-Litterman diversification all in one easy-to-use system.

Reclaim Time: Automated data pulls, overnight grid searches, automatic rebalancing so you can focus on the most important part: your strategies.

Compete Fairly: Same hedge fund-quality algorithms, professional-grade tools, and automated execution edge as billion-dollar funds. Designed for the solo-trader.

Grow in Community: Private Discord mastermind, live Q&A with Matt & Jason.

The Quant Scientist PRO-Algorithmic Trader System

A comprehensive learning program designed to help you start, grow, and automate your financial investments with our suite of professional tools.

(even if you don't have financial knowledge, Python experience, or tons of money to invest)

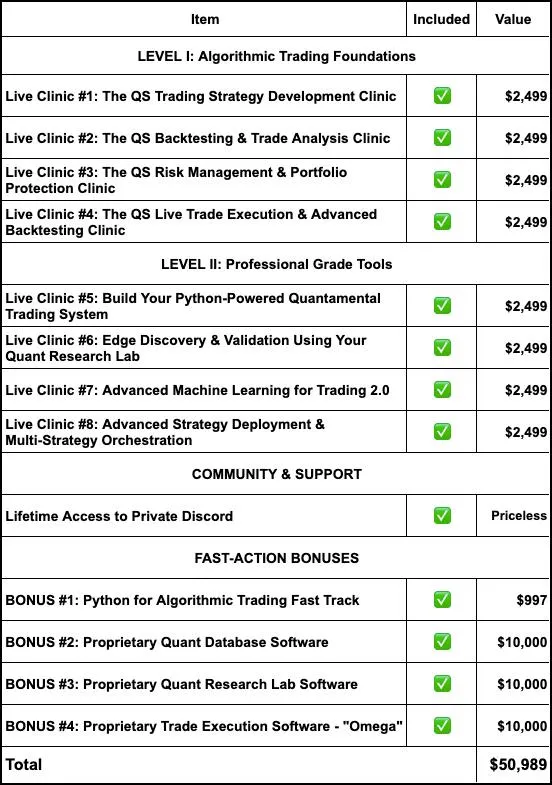

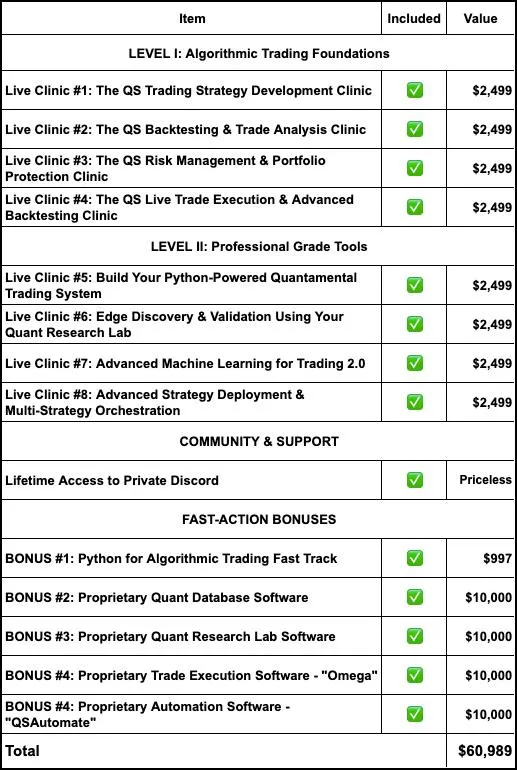

Summary of Everything You Get:

Based on an independent evaluation, this program is packed with $50,989 in value.

Let us show you how to go from a novice to a pro capable of making $1,000 a day (or more) and charting your own financial destiny.

The Quant Scientist PRO-Algorithmic Trader System

Here's everything you get:

8 Live Clinics & Recordings ($19,992)

BONUS #1: Python Fast-Track Bootcamp ($997)

BONUS #2: QSConnect Licence ($10,000)

BONUS #3: QSResearch License ($10,000)

BONUS #4: Omega License ($10,000)

BONUS #5: QSAutomate License ($10,000)

Lifetime Access & Private Discord (Priceless)

Total value: $60,989

Today Just $4999

** Guaranteed SAFE Checkout Powered by Stripe **

"Up 11.5% in my first 13 days of trading!"

"It is very much a more scientific way of investing." - Leo

Why Choose Us?

Compare our program to the $23,000 CQF program—their program has NO proprietary software or live coaching. At $4,999, The Quant Scientist PRO-Algorithmic Trader System delivers more power for 78% lower cost.

Proprietary Software: QSConnect, QSResearch, Omega, and QSAutomate—proprietary trading tools you won’t find elsewhere.

Proven Wins: Students results that speak for themselves.

All-in-One: From basics of algorithmic trading to advanced automation, it’s all here.

Expert Guidance: Matt and Jason bring real-world quant success.

No Coding Experience? No Problem

New to Python? Our Fast-Track Bootcamp and copy-paste notebooks get beginners running their first paper trade in under an hour.

Let our easy-to-use system help you get started today!

You Don’t Need A "Large Account Size" To Make This Work

These results are on $10K initial investment.

GCLNYC up $1,300 on an initial $10K.

Jim was up $534 on an initial $10K.

This Course Is Everything We Wish We Knew Before We Started Investing

We will show what helped us grow 7-figure portfolios, live debt-free, and achieve financial freedom.

The Quant Scientist Pro-Algorithmic Trader System

$4,999

** Guaranteed SAFE Checkout Powered by Stripe **

No Finance Background?

Hear what students with no or minimal finance backgrounds thought.

Leo Timmermans

⭐️⭐️⭐️⭐️⭐️

"I am really amazed about Jason's knowledge and the way he can explain stuff even to guys like me, that don't have a finance background."

Jonathan Ng

⭐️⭐️⭐️⭐️⭐️

"This program is structured really well with a nice level of progression and focus on the fundamentals, and some really cool trading strategies that I haven't seen covered elsewhere."

David Tello

⭐️⭐️⭐️⭐️⭐️

"It is clear to me that Jason is very skilled in math/stats and its applications. I like that I can ask him questions about the math and he knows exactly how that applies to the finance."

Grow Your Investments WITHOUT Paying Financial Advisor Fees

"I had no background in finance. My cumulative returns are +25%. My financial planner didn’t come close to that." -- dstephens180

How Can We Help You Grow Your Investments As Mentors?

There's a lot of "mentors" out there. But picking the right mentors is one of the biggest contributors of algorithmic trading success.

This is why we are the right mentors to help you grow your investments.

MEET THE CO-FOUNDER & HEAD OF ALGORITHMIC TRADING

Hey, I'm Jason

I started algorithmic trading in early 2000 with stocks and options. I have over 20 years of quant experience at companies including:

Global Head of Derivatives Market Risk Development at BP Trading

Derivatives Trader at Trade Group

Trading Risk Manager at JP Morgan Chase

Head of Engineering, Data Science, and Analytics at Rio Tinto

And I have been developing Python trading software and algorithmic trading strategies ever since!

MEET THE CO-FOUNDER & HEAD OF Data Science

Hi, I'm Matt

I started trading in 2008. But my learning path as been far from "linear":

I am not a "traditional quant"

I have 15+ years experience in data science, analytics, and time series

I lost $30,000 on my first trades

I've since grew my investment portfolio to $7.5 million

Jason and I teamed up to combine our strengths in quant finance, trading, and data science!

Don't worry, we can help you troubleshoot software, implement strategies, and build your confidence!

Get the Technical Knowledge to Become a More Successful Trader.

"The depth of technical knowledge is exactly what I was looking for." --Joey

"It was a 5.6% return (on $10,000 in 1 week)." --Joey

Alright, I've Seen Enough

WHAT OTHERS ASKED BEFORE THEY ENROLLED

Frequently Asked Questions

Here's a curated list of the most common questions students had before they enrolled with us.

Question 1: I have no investing knowledge. Is this for me?

Absolutely! This course starts with the foundational principles and takes you all the way through more advanced algorithmic trading strategies. The course is eight weeks long and gives you ample time to practice what you learn, watch and re-watch the content as well as ask questions and get support from our coaches.

Question 2: I have no finance knowledge. Is this for me?

Absolutely! We cover the core financial topics in depth during the live clinics so you can rest assured you will know exactly how to implement the strategies and techniques covered. Plus, you have access to our trader community where you can ask questions if something is tripping you up.

Question 3: I have no Python knowledge. Is this for me?

This course does not cover the basics of Python. However, we provide full code templates and support you during the Python software installation process. We recommend knowledge of Python, Pandas, and Conda Environments. You can learn these in either the PyQuantNews Course (best for finance enthusiasts) or the Python for Data Science Automation Course (best for data science enthusiasts).

Question 4: What online broker do you use?

We use Interactive Brokers and the Interactive Brokers API. The Omega "Hedge Fund in a Box" is set up for Interactive Brokers. We apologize, but we do not use other brokers at this time.

Question 5: I have a different broker than Interactive Brokers. Can I still do this program?

We use Interactive Brokers and the Interactive Brokers API. The Omega "Hedge Fund in a Box" is set up for Interactive Brokers only at this time. We will guide you on how to open up an account with Interactive Brokers. We apologize, but there's a ton of setup required to support other brokers, and it's not feasible at this time.

Solution: If you are open to starting a brokerage account with Interactive Brokers, we will teach you everything you need to know on how to trade with it and get up to speed fast.

Question 6: How long does it take to get trading?

Most students are trading within the first 3 to 5 days. However, there is setup time for getting an Interactive Brokers account (typically takes 24 to 48 hours). In addition, paper trading account resets take 24 hours. So figure 3 days for account setup and Python software environment setup.

Question 7: Will you advise on what stocks to trade?

Quant Science, LLC is an educational platform. We do not provide personal trading advice or trade on your behalf. With that said, the trading algorithms and strategies are designed to do a lot of the heavy lifting. We give you our "Core 3" trading strategies in the course.

Question 8: How does this impact my taxes?

You should consult your tax advisor about any tax consequences and your financial advisor for any impact to your personal taxes.

Question 9: Do you offer Refunds?

This is a limited seat cohort-based system. When you enroll, you are taking a seat from someone else. Therefore we do not offer refunds.

Question 10: Do you guarantee results?

There are lots of factors that can impact whether you make money with the stock market. We are confident that if you follow our strategies and ask questions in the coaching community that you will increase your chances of making consistent gains. However, we do not guarantee results.

Question 11: Are there any additional costs required to complete the program beyond the enrollment fee?

We've done our best to minimize the costs. However, most students opt for the $14.99/mo Interactive Brokers Market Data subscription available for Non-Professional Investors. This allows Omega to access Real-Time Market Data across 100s of exchanges via Interactive Brokers.

Once you begin to grow your account and do backtesting more frequently, we recommend additional data subscriptions including Financial Modeling Prep (FMP), which we have 30% OFF discount that we've negotiated to help our students. But this is not required to complete the course.

Also optional (not required), you may consider VectorBT PRO, which we will cover in the Advanced Backtesting Clinic (Clinic #4).

Question 12: What if I cannot attend a live clinic session?

No problem. All live clinics are recorded and uploaded within 24 hours. You'll have access to the code, video recording, slides, and resources for all clinics.

Question 13: What happens when I enroll?

You will receive a Welcome Email (allow 60 seconds for the server to process). The welcome email will give you step by step instructions on how to access the course, join our trader community, and get started. Note that the live content will be announced at the kickoff meeting for your cohort.

If you get stuck with accessing your course, please email us at info@quantscience.io.

Question 14: What if something comes up or I don't have enough time?

We understand that life is busy and things come up. That's why all live clinics are recorded and provided within 24 hours. The clinic recordings come with code and resources. And you can watch on your schedule.

Question 15: Do I get lifetime access?

Yes, once you purchase the program, you get lifetime access to the program content and community.

Get on board and start, grow, and automate your investments to gain financial freedom!

The Quant Scientist Pro-Algorithmic Trader System

$4,999

** Guaranteed SAFE Checkout Powered by Stripe **

Copyright Quant Science, LLC 2026

You'll Have Everything You Need To Compete With Hedge Funds When You Implement The 8-Step Roadmap We Share In The Quant Scientist PRO-Algorithmic Trader Program

You will...

Open a trading account with Interactive Brokers and learn the basics of getting started (if you’re a beginner with no prior algorithmic trading experience)

Get an algorithmic trading system. Plan your way to success, minimize risk, and protect your money (you’ll practice your skills in Paper Trading, i.e. you’ll trade with fake money, build your confidence before you make the leap to live trading).

Automate trading just like the "Big Guys". Get our exact automated trading system that is powering our hedge fund (making us money while we sleep).

Make trading for growing your investments a reality without losing money, sleep, or your mind!

These outcomes are totally within reach for you and your investment goals (even if you're starting from scratch or have traded before).

The truth is...

WE WEREN'T ALWAYS THIS FINANCIALLY INDEPENDENT

And we made many of the same mistakes as you

Matt lost $30,000 in his first 6 months of trading. Matt made the mistake of listening to a strong TV personality and holding onto losing trades too long.

Jason lost $9,000 on his first options trade. He paid his "Market Tuition", which is money many beginners lose when they first start trading.

Matt dropped $5,000 on a "technical trading" course. And lost $13,000+ applying their "chart reading" framework.

But we overcame our mistakes and built 7-figure investment portfolios.

Matt's $7,276,854 Investment Portfolio

Algorithmic Trading Can Give You:

Confidence in your financial situation.

A way out of your current career.

A way to grow your investments.

Algorithmic Trading Gave Us:

Financial freedom to travel, raise a family, and improve our lifestyles.

10X growth in our financial portfolios. In just the last 2 years our portfolios have grown into the multi-7-figures.

The ability to help friends and family. Matt was able to help his family out financially during tough times when a member of his family couldn't work for over 3 years.

Freedom to pay off debts, loans, and mortgages. We now live debt-free. No loans. No mortgages. Zero debt.

Growth in our retirement savings. Building a retirement fund and planning for the future.

No boss. We grew our independence. And, now, we can call our shots.

The ability to reinvest the money. The biggest secret to our financial freedom has been reinvesting the money.

You can make $100 a day with algorithmic trading

JUST USING YOUR COMPUTER...

That Equals:

Up to

$525 a week

Up to

$2,100 a month

Up to

$25,200 a year

WHAT'S INSIDE OUR UNIQUELY POWERFUL SYSTEM:

Everything you need to compete with the "Big Guys".

Bonus #1: Trading account setup, python setup, and live order execution

Get the Quant Scientist Python Stack installed

Create an account with Interactive Brokers

Set up your Trader Workstation

Connect Python to the Trader Workstation

And execute a paper trading strategy risk-free

THE SECRET SAUCE:

Get 4 Live Trading Clinics with Jason and Matt

(Read On To Learn More...)

Step 1: Get our Top 3 Trading Strategies (Live Clinic #1)

Get our 5-Step Framework for Profitable Trading

Learn our Top 3 Trading Strategies

Strategy 1: Volatility targeting with auto-rebalancing

Strategy 2: Momentum factor with auto-rebalancing ($2,100 Value)

Strategy 3: Algorithmic crack spread versus refiner ($2,100 Value)

Get Jason and Matt live for an hour and a half ($3,000 Value)

Step 3: Learn how to Backtest the right way (Clinic #2)

Detailed walkthrough of event-based backtesting ($1,999 Value)

Backtested portfolio strategies with Zipline Reloaded

Introduction to factor-based trading strategies ($2,100 Value)

How to avoid mistakes in backtesting

And you get Jason and Matt live for an hour and a half ($3,000 Value)

Step 4: Manage Your Risk and Protect Your Money (Live Clinic #3)

Detailed walkthrough of key performance and risk metrics ($1,999 Value)

Risk analysis of our trades with Pyfolio Reloaded

Which KPIs actually matter (and which ones to avoid)

($2,100 Value)

When to iterate (our core key risk levels) ($1,999 Value)

How to go directly into paper trading

Jason and Matt live for an hour and a half ($3,000 Value)

Step 5: Learn Advanced Backtesting (Clinic #4)

Detailed walkthrough of how to execute and manage your trades ($1,999 Value)

1 New Trade: A multi-asset trading strategy ($2,100 Value)

1 new technique that gives you 100X faster backtesting ($1,999 Value)

Jason and Matt live for an hour and a half ($3,000 Value)

This is what it feels like to use Omega...

"Orders submitted successfully." --Laz D.

"I enjoyed hearing that lovely British computer man say, 'Order Filled'" --Maxy

"Order filled via Omega" --Harry

"It's exhilarating and frightening at the same time to get so many trades with so few keystrokes" --Priority

WHAT OTHERS ASKED BEFORE THEY ENROLLED

Frequently Asked Questions

I have no investing knowledge. Is this for me?

Absolutely! This course starts with the foundational principles and takes you all the way through more advanced algorithmic trading strategies. The course is eight weeks long and gives you ample time to practice what you learn, watch and re-watch the content as well as ask questions and get support from our coaches.

I have no finance knowledge. Is this for me?

Absolutely! We cover the core financial topics in depth during the live clinics so you can rest assured you will know exactly how to implement the strategies and techniques covered. Plus, you have access to our trader community where you can ask questions if something is tripping you up.

I have no Python knowledge. Is this for me?

This course does not cover the basics of Python. However, we provide full code lessons and support you during the Python software installation process. We recommend knowledge of Python, Pandas, and Conda Environments. You can learn these in either the PyQuantNews Course (best for finance enthusiasts) or the Python for Data Science Automation Course (best for data science enthusiasts).

What online broker do you use?

We use Interactive Brokers and the Interactive Brokers API. The Omega "Hedge Fund in a Box" is set up for Interactive Brokers. We apologize, but we do not use other brokers at this time.

I have a different broker than Interactive Brokers. Can I still do this program?

We use Interactive Brokers and the Interactive Brokers API. The Omega "Hedge Fund in a Box" is set up for Interactive Brokers only at this time. We will guide you on how to open up an account with Interactive Brokers. We apologize, but there's a ton of setup required to support other brokers, and it's not feasible at this time.

Solution: If you are open to starting a brokerage account with Interactive Brokers, we will teach you everything you need to know on how to trade with it and get up to speed fast.

How long does it take to get trading?

Most students are trading within the first 3 to 5 days. However, there is setup time for getting an Interactive Brokers account (typically takes 24 to 48 hours). In addition, paper trading account resets take 24 hours. So figure 3 days for account setup and Python software environment setup.

Will you advise on what stocks to trade?

Quant Science, LLC is an educational platform. We do not provide personal trading advice or trade on your behalf. With that said, the trading algorithms and strategies are designed to do a lot of the heavy lifting. We give you our "Core 3" trading strategies in the course.

How does this impact my taxes?

You should consult your tax advisor about any tax consequences and your financial advisor for any impact to your personal taxes.

Do you offer Refunds?

This is a limited seat cohort-based system. When you enroll, you are taking a seat from someone else. Therefore we do not offer refunds.

Do you guarantee results?

There are lots of factors that can impact whether you make money with the stock market. We are confident that if you follow our strategies and ask questions in the coaching community that you will increase your chances of making consistent gains. However, we do not guarantee results.

Are there any additional costs required to complete the program beyond the enrollment fee?

We've done our best to minimize the costs. However, most students opt for the $14.99/mo Interactive Brokers Market Data subscription available for Non-Professional Investors. This allows Omega to access Real-Time Market Data across 100s of exchanges via Interactive Brokers.

Once you begin to grow your account and do backtesting more frequently, we recommend additional data subscriptions including Nasdaq Data Link for 21,000 US Equities ($50/month). But this is not required to complete the course.

Also optional (not required), you may consider VectorBT PRO, which we will cover in the Advanced Backtesting Clinic (Clinic #4).

What if I cannot attend a live clinic session?

No problem. All live clinics are recorded and uploaded within 24 hours. You'll have access to the code, video recording, slides, and resources for all clinics.

What happens when I enroll?

You will receive a Welcome Email (allow 60 seconds for the server to process). The welcome email will give you step by step instructions on how to access the course, join our trader community, and get started. Note that the live content will be announced at the kickoff meeting for your cohort.

If you get stuck with accessing your course, please email us at info@quantscience.io.

What if something comes up or I don't have enough time?

We understand that life is busy and things come up. That's why all live clinics are recorded and provided within 24 hours. The clinic recordings come with code and resources. And you can watch on your schedule.

Do I get lifetime access?

Yes, once you purchase the program, you get lifetime access to the program content and community.